Throw me to the bulls and the bears to eat me, and i will come back commanding them!

This is the third book of our series. It is crucial since it not only summarizes all of the knowledge from the previous two parts, but also illustrates numerous fantastic and current market examples of combining direction and volume methods.

You will not have to read any theoretical fiction in this book. It is a publication steeped in practice, so your workshop will polish you and practical examples will help you consolidate the knowledge from prior portions. This section is designed to increase your sensitivity to market information and train your eye to spot any small bit of extra money that arrives on the market.

According to the phrase on the front of our book, if somebody ever tosses you into the market to be eaten by bulls or bears, you will comeback commanding them.

A genuine market warrior is humble and patient… He does not fight the market, but he can listen to it, which is why he always wins. This book will present you with numerous rewarding findings that will enable you to compete with the most powerful market participants… Remember that you will be fighting alongside them against these unsuspecting traders. In this case, the one with the most information wins!

Market sentiment analysis without secrets! Control the movements of large traders

You learned about two powerful techniques in the previous two parts: Sentiment and Real Volume. It’s now time to put them all together. This book will provide you with additional market examples of merging these two market approaches. You have gained a market advantage at this point, which must now be maintained. You must tame the market, subdue it, and follow the market makers.

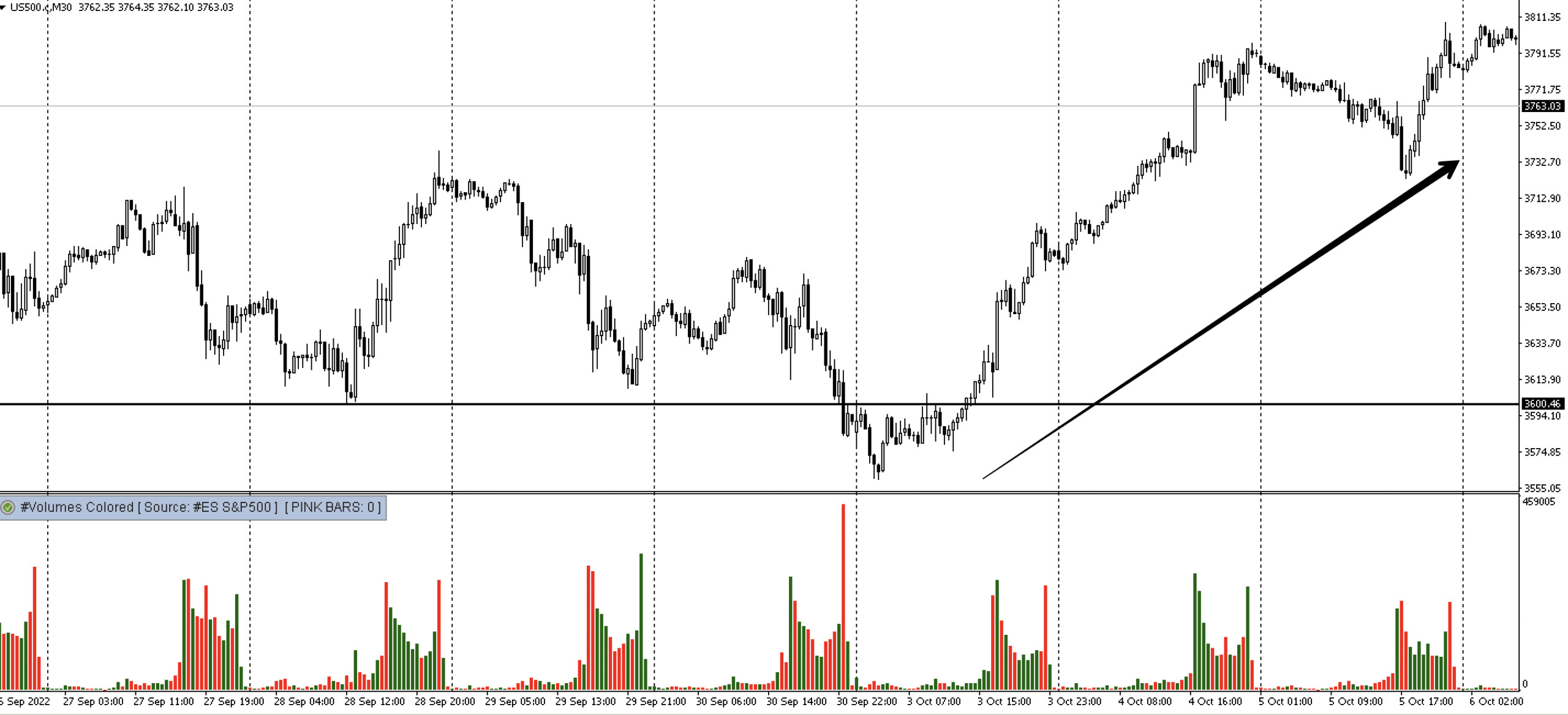

Case no. 1 - SP500

The SP500 chart above shows a downward trend. The Federal Reserve’s monetary policy, as well as global risk, contributed to negative mood. Of course, some investors believe that buying stocks is a good idea. But the question is, how much can you hold on to before the price starts to rise? The book The Art of Speculation will teach you how to identify highs and lows with extraordinary accuracy. Correlations between markets are not expressed as percentages. Correlations are formed by the market, specific levels, and information.

It is worth mentioning that 10-year US bond yields were close to the important resistance level of 4%. What did the market have to say about it?

„There’s a reasonably strong consensus that anything around 4%…” Source: ForexLive

Analysts anticipated that anything at this level would be appealing for trading. You will also learn how to use bond yields as a support indicator in our e-books.

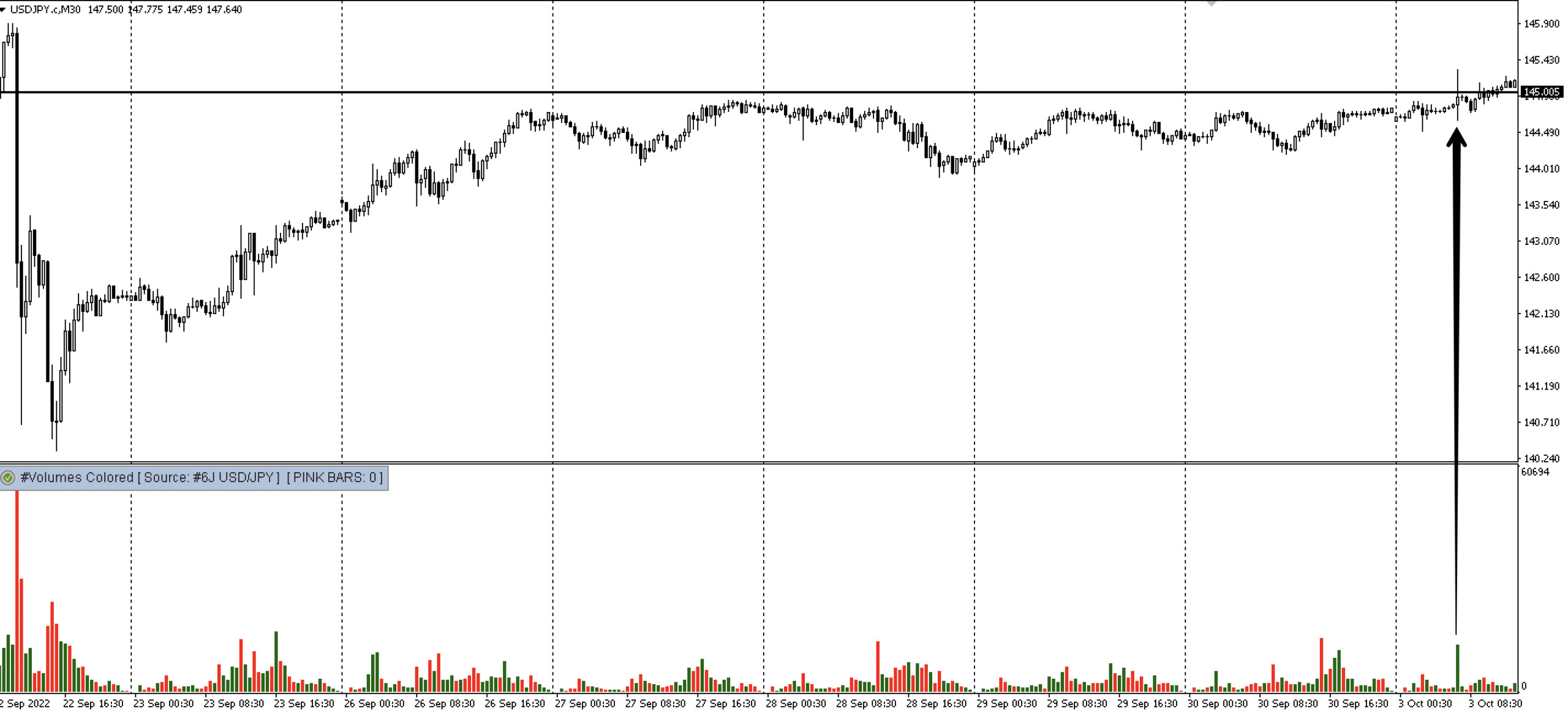

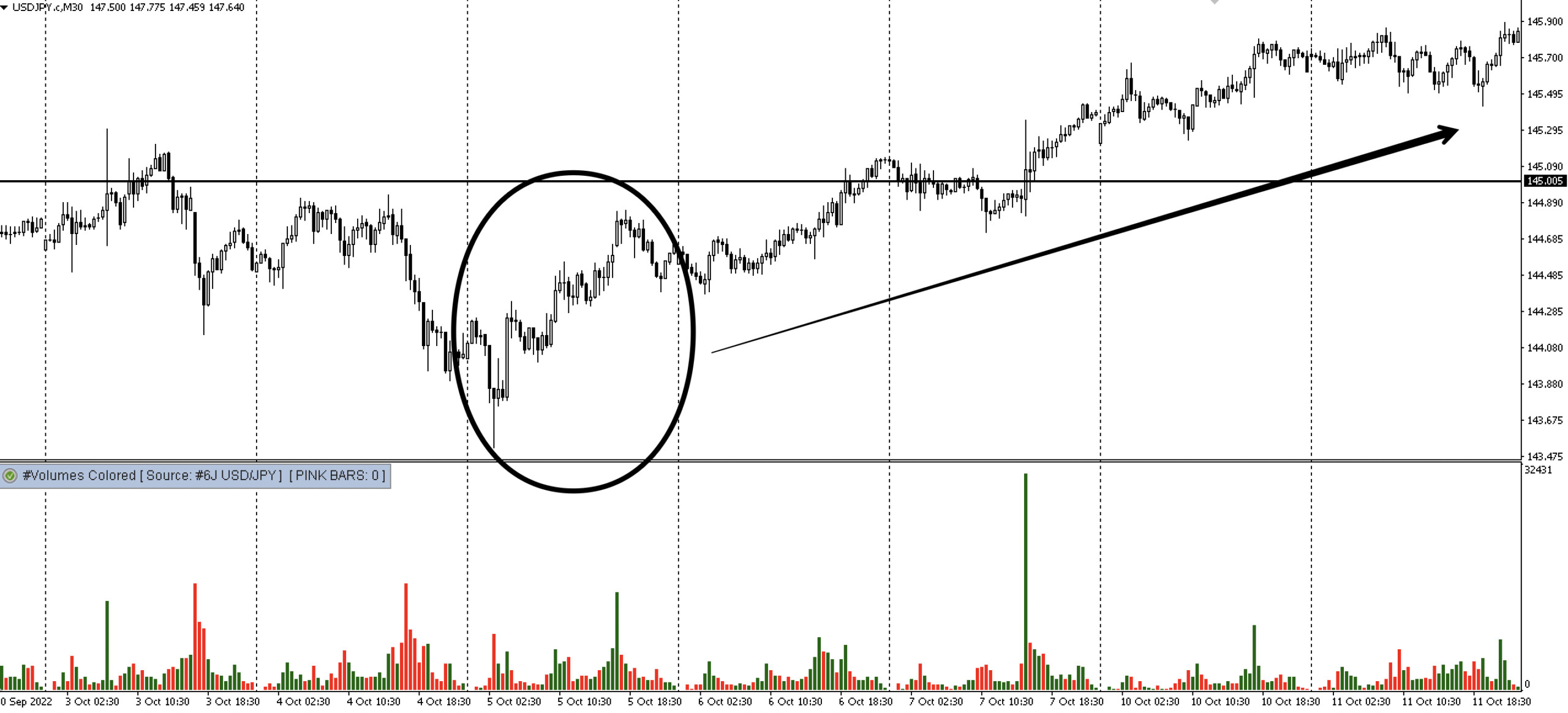

Case no. 1 - USDJPY

On the same day, the USDJPY struck a critical resistance level of 145.00.

If you’ve previously read the second part, you’ll notice what indication USDJPY provided. The supply was already in the market at this point, and the Bank of Japan had intervened verbally.

„Japan finance minister Suzuki says sharp FX moves are undesirable”

This indicated a significant likelihood of decline. Volume and moods both suggested the downside possibility.

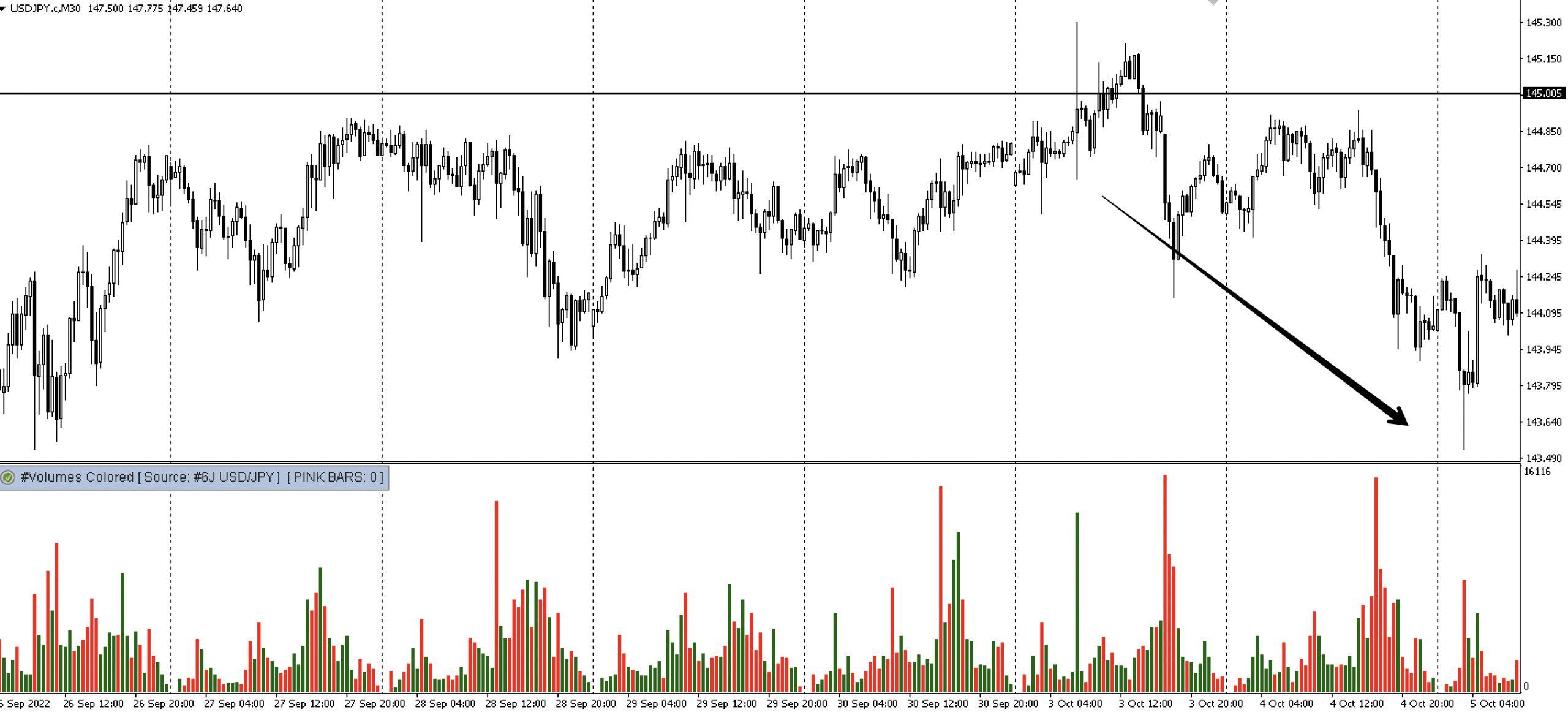

Case no. 1 - USDJPY

In line with this sentiment, the USDJPY recovered from 145 and declined. Remember that yields below 4% provided a lot of support for this choice. You’re undoubtedly wondering how you’ll determine which level is critical for the market. If you’ve read the first part of our series, you’ll know where to go for information and what the market thinks about levels. You have access to everything. You won’t have to make any guesses. You have access to this information on a daily basis.

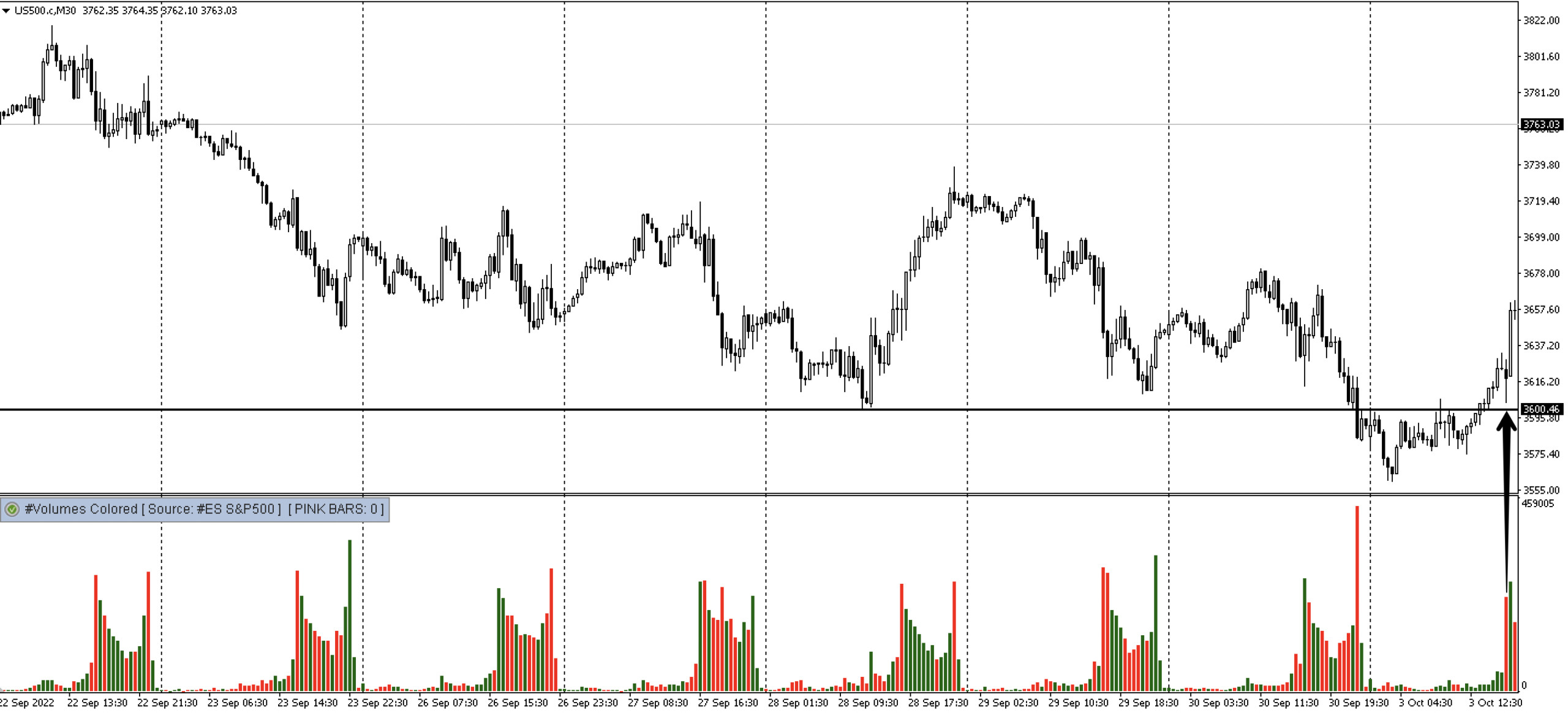

Case no. 1 - SP500

Let’s return to the Sp500. We knew the USDJPY was under pressure, and we also knew bond yields were under pressure. It predicted a strong rebound in the indexes, but would we see it on the volume?

The candle was not large in the M30 interval, but it created a large shadow from the bottom and had a significant volume. The M5 was also intriguing.

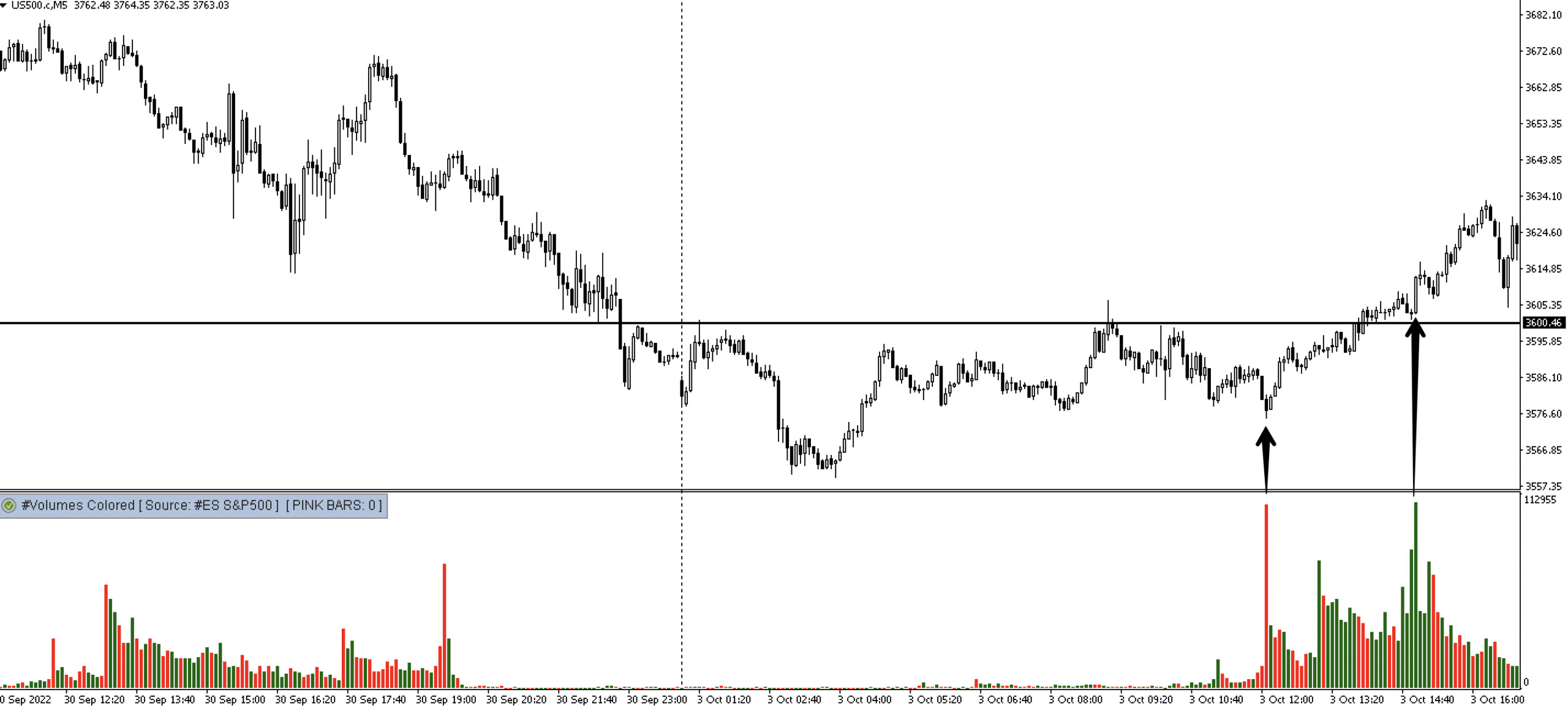

Case no. 1 - SP500

A tiny candle, a massive volcano! and then confirmation of demand when the 3600 level is broken. This indicates a low price! You will study this art in the art of Speculation.

Case no. 1 - SP500

There are no coincidences here! You just need to know how to read the market and where to look for information. Take note that this was a watershed moment and an excellent time to hunt for a long trade.

We have one more thing to say! Earlier this week, there was speculation that a weak NFP would prompt the Fed to rethink its monetary policy. There was discussion on lowering the dynamics of interest rate hikes. It was also one of the factors for the SP500 and USDJPY declines. Please observe how many arguments there were for these moves. However, can these moves be sustained for an extended period of time? Otherwise, how long can they last?

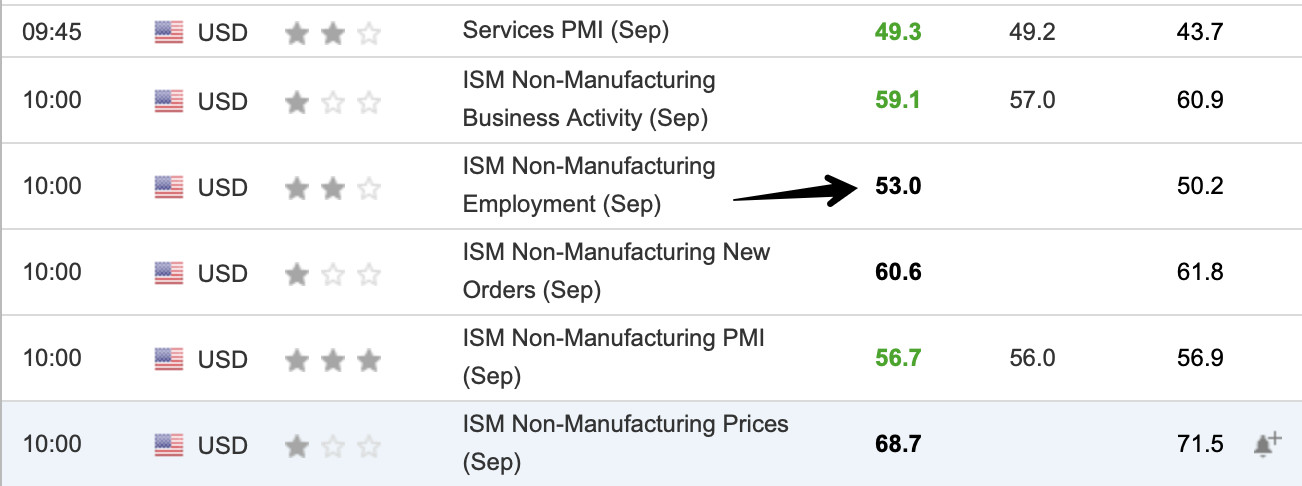

NFP Forecast

The findings of the ISM index for services were scheduled to be released in the coming days. This is an important predictor of the NFP’s prognosis. At the start of the week, the market anticipated a disappointing NFP, which resulted in a correction. Look at the data that was published two days later.

The ISM index’s employment component for services has grown. This startled the market and raised expectations for worse NFP numbers. Worse data suggested lesser interest rate increases. So consider the USDJPY scenario.

Case no. 2 - USDJPY

This provided the dollar new strength, and USDJPY proceeded to rise from that point forward. So, how about the SP500?

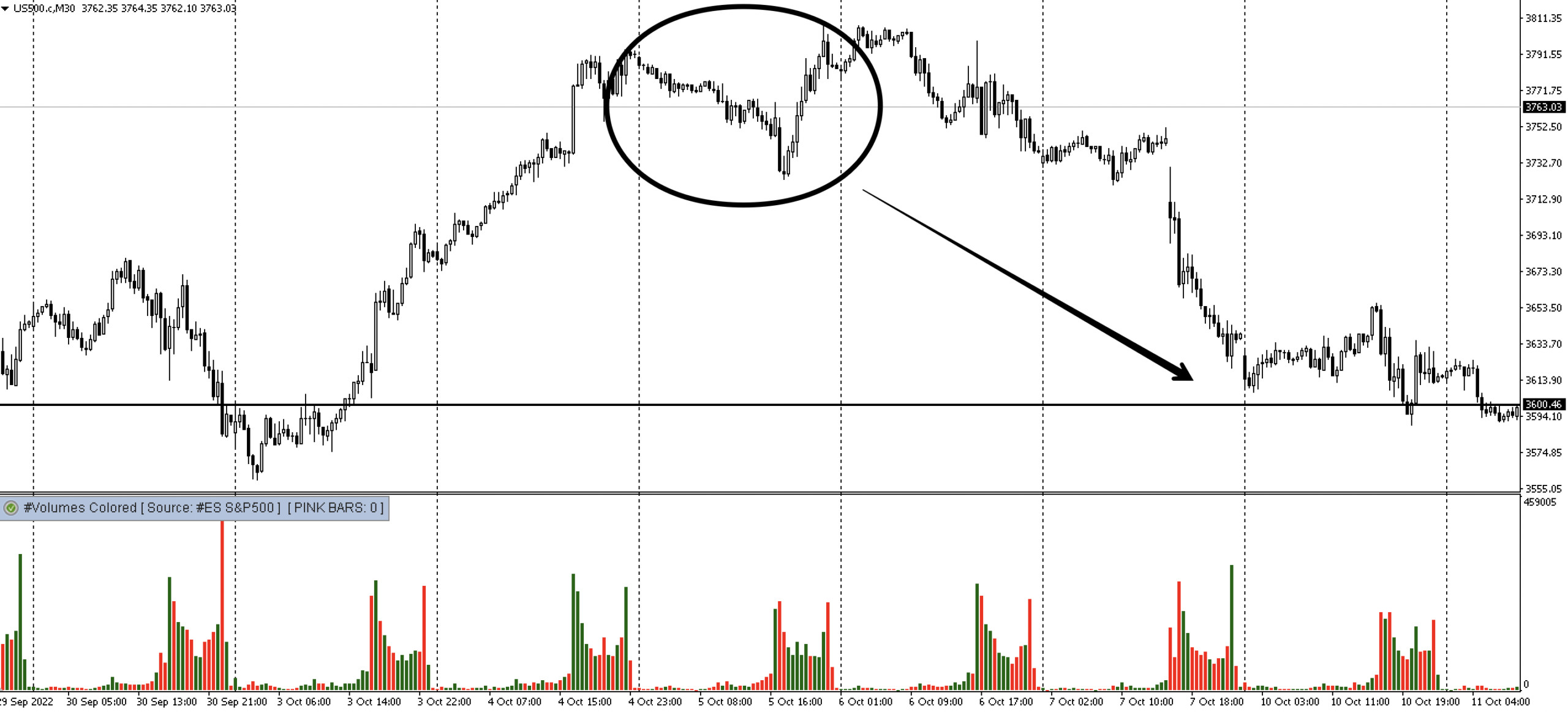

Case no. 2 - SP500

Expectations for a better NFP mean the risk of more aggressive interest rate hikes. The Sp500 has also begun to fall again.

It’s worth noting that this was not a fleeting occurrence. The decreases persisted in the days that followed. This provided the market with a clear direction. Yes… This is the trading potential. Do you believe that market movements are random? You’re mistaken. Everything has a purpose. You will be aware of the market’s direction in advance! Nothing will ever surprise you again. This is the power of this knowledge. Don’t believe anyone who says the market is unexpected. That is what people who lack information and abilities say. The market can be read like a book, but only in this case can you influence what happens next!

Consolidation? It does not exist! We know where the market is going

Consolidation? Nonsense. Take note that we demonstrated how to identify a market comeback – a correction – in advance. We showed you how to detect the market turning point again a few days later. The market dropped and then surged again. Some refer to it as a corrective. We was trading both up and down, and we knew exactly when each move began and ended. Do you see the distinction? Consolidation is not an option for me. Every action is predictable. You have a decision to make. He may continue to believe that the market is incomprehensible, or he may take a step ahead and learn knowledge that more than 90% of traders lack. Join the trader’s team.

What you will get from reading this book?

no. 1

You will systematize all the knowledge learned in the previous two parts

no. 2

You will learn how to use both strategies from the previous parts in the current market conditions

no. 3

You will learn how to effectively combine a Direction Strategy and a Volume Strategy

no. 4

You will gain confidence in understanding the information coming from the market

no. 5

You will systematize the technique of trading on the market based on the real volume and Price Action

Our readers can watch our live trading on TradingHub. Improve your skills!

Have you ever seen a author supporting his readers?

Sure, he do it! Matt have been operating a group of traders for years who get a daily overview of sentiment and likely market direction. Furthermore, they receive press every day, and live trading. When a transaction is opened, it displays on the forum. He also keep the group informed about the real volume and sentiment.

Markus –

A great combination of trading strategies. When will the fourth book be released? I can’t wait!!!!

Philip –

a lot of reading and a lot of knowledge. The previous parts are also ok, I’m glad I came here…

Steve –

ok

Scott –

interesting summary of knowledge from the previous two books. It was good to sort this out. It helped me understand the strategy

William (verified owner) –

Yes! this kind of trading is a real art! I’m amazed

Khan –

cool!

Chris (verified owner) –

I’ve read all of them and it’s really worth your attention. I hope there will be more and now I’m practicing in the trading hub

Alexander –

Interesting

Richard –

A great complement to the previous parts, but there could be more pages 😉

Carlos –

Nice summary of all the parts

Lisa –

masterful approach to the market!

Darrell –

there should be more books like this. It’s great that the author also provides mentoring in the trading hub

Jacob –

superbe série de livres